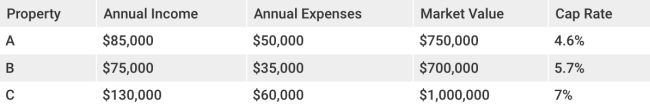

7 cap rate

Above, the cap rate calculation assumes you are receiving full rent each monthly. In other words, the property is 100% used 365 days a year and your tenants pay the rent. A single-family home might experience 100% occupancy on a regular basis, but it is less likely in multi-unit buildings that have more turnover. In order to calculate your cap rate, make sure you account for less than 100% occupancy. Here's how: