what is a good cap rate for multifamily

A lower caprate often means higher appreciation potential, and safer investments. However, a lower cap rate can indicate greater appreciation potential and less risk.

Your investment type will dictate the cap rate you select. Higher cap rates might be more appropriate for those who are seeking higher potential revenue and greater risk. If you're looking for something safer, a lower cap rate is an indication of that. As an illustration, a 20% junk-bond is no better than a 2 % T-bill. Both have their purpose, and it all depends on what your investment goals are. What is a good cap-rate for multifamily? Choose one that aligns with you goals and provides adequate risk reward!

Consider not only the cap rate, but also hold time and appreciation, as well as cash flow. All of these are valid criteria for investors to consider. This will help you to determine the capitalization rate that you desire and need.

A lower caprate often means higher appreciation potential, and safer investments. However, a lower cap rate can indicate greater appreciation potential and less risk.

A low capitalization rate usually doesn't generate a large monthly cash flow. It will appreciate over time, however.

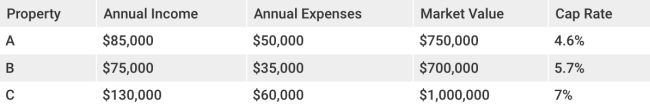

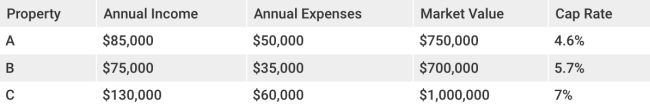

Capitalization rate is a measure that tells investors how long it will take for them to make their investment back. Divide the NOI by your property's purchase price to calculate the cap rate.

These are only two aspects that contribute to the calculation of the cap rates. The cap rate should not only be determined by income, but also price

How do you know whether your real estate investments are a waste of time or profitable? It's very simple: Cap rate.