what is a good cap rate for an apartment building

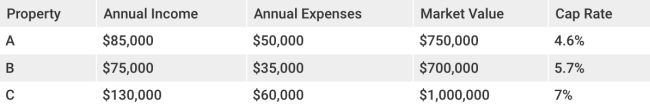

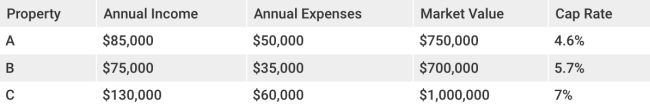

Cap rates, expressed as percentages, represent the return for a single point in the future. They are used for the evaluation of individual investment properties and to compare properties.

The cap rate in real estate investing refers to the unlevered yield on an asset, based on its annual net operation income (NOI).

Different cap rates between properties or different cap rates over different time horizons for the same property will indicate different levels risk. If properties have higher net operating income but lower valuations, the cap rate value will be greater.

Cap rates, expressed as percentages, represent the return for a single point in the future. They are used for the evaluation of individual investment properties and to compare properties.

It is essential to do your homework when investing in real estate. You should do thorough research on the property before buying an income property. It is important to understand how to run the numbers in order to make an informed decision on whether or not it is a wise investment. Many investors use the cap-rate formula to analyze real property deals. However, it is not easy to determine what a good rate of return is

Although the cap rate can help you quickly compare the relative values of similar real-estate investments on the market, it shouldn't be used to determine an investment's strength. It doesn’t account for leverage, time value of money and future cash flow from property improvements among other factors.

Capitalization rate, also known as cap rate, is one common return measure used for evaluating performance of current or prospective real-estate investments.

There are not clear ranges of a good and bad cap rate. They largely depend on the market and the context.