what cap rate is good

Annual operating expenses are $5,800, $3,800 in property taxes, and $2,000 for maintenance.

The above cap rate calculation assumes that you receive full rent each month. This means that the property is 100% occupied for at least one year. For a single-family home, 100% occupancy is possible but less so for multiunit buildings with higher turnover. When calculating your cap rate, it's important to take into account a lower than 100% occupancy rate. Here's how:

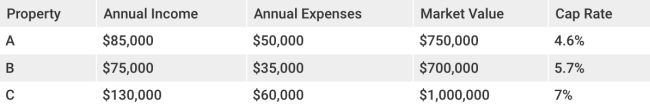

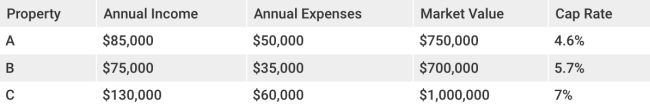

It is important to compare and calculate the cap rates for similar investment properties. Comparing the cap rates of similar properties can help you decide which property is a better fit for your portfolio.

Annual operating expenses are $5,800, $3,800 in property taxes, and $2,000 for maintenance.

The cap rate of potential investments can help you determine if the asking price seems reasonable. If it is too high based on your cap rates calculations, you may be able negotiate a lower price.

When assessing property you expect to generate regular, predictable income, the cap rate can be a useful metric. You might calculate the cap rate of a 4-unit apartment block occupied by tenants on year-long leases.

Real estate investors often include a 5--10% expected loss of rent in their calculations. Assume a 90% occupancy rate in the above example.

Net operating income: This is your gross rental income minus operating expenses such as payroll and repairs. This is how you calculate this number: