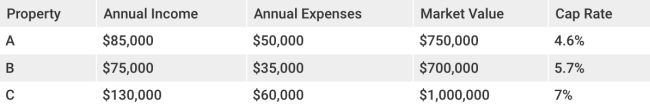

good cap rate on rental property

The mortgage expense is not included in the cap rate. This is because it doesn't factor in financing terms, interest rates or any other considerations. This is how it concentrates on the property without all the distractions that come with financing.